For private investors seeking maximum returns, co-investments are key to attractive investment multiples. Before we dig into the details, it is worthwhile to clarify the relevant terminology in this article:

A fund investment is an investment made by an LP into a VC/PE fund (e.g. Family Office invests in Venture Fund)

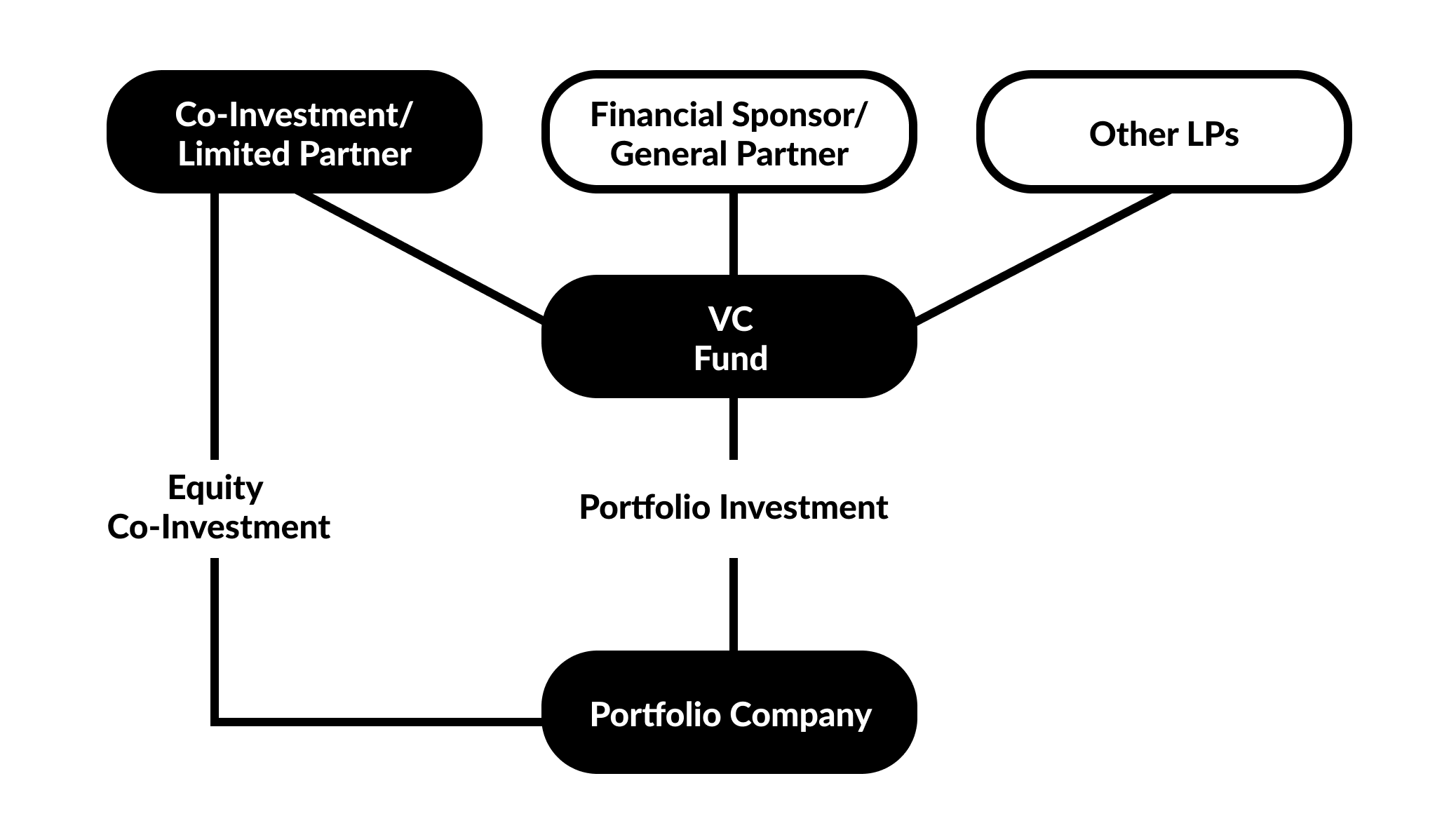

A co-investment is an investment where LPs allocate additional capital directly into companies alongside or following VC/PE investors (e.g. Venture Fund invests in Portfolio Company; Family Office also invests directly in this Portfolio Company)

A direct investment is an investment made directly into a private company without the participation or involvement of a VC/PE fund (e.g. Family Office invests in Startup; Startup is not in the portfolios of any of the Family Office’s invested Venture Funds)

Figure 1. Equity Co-investment & Direct Fund Investment Diagram

There are multiple benefits to co-investments. For one, you are able to gain more insight into portfolio companies through current fund exposure, data, and performance than you do with individual direct deals. You can cherry-pick the winners, increase your equity stake, and ultimately increase investment multiples. An added perk of co-investments is that they typically have zero or reduced fees (compared to the typical 2% management fee / 20% carry on fund investments). We can observe these benefits in the following chart:

Figure 2. Survey of fund managers comparing co-investment performance to fund returns

Source: Prequin

For GPs, offering co-investments provides them with an additional capital source to make larger investments. This can be particularly useful when a fund is close to being fully deployed and when follow-on capital requirements exceed reserves as per portfolio construction models. GPs typically only offer co-investments to anchor LPs and other LPs with whom they have an established relationship. This practice improves the overall marketability of the fund as LPs are provided more lucrative co-investment opportunities.

Figure 3. Co-investment vs. Direct Investment Deal Value (2012–2017)

Source: McKinsey, Pitchbook

With these benefits, co-investing activity has been rising in the past few years. According to McKinsey, co-investments have doubled from $45 billion to $104 billion since 2012 while direct fund investments have remained relatively stagnant. As more investors and fund managers recognize the benefits of co-investment opportunities, we can only expect this trend to continue.

That being said, while co-investment opportunities presented may seem favorable, LPs should still ensure that proper due diligence is conducted. Depending on the transaction size, these types of investments may disproportionately increase concentration relative to fund investments, as capital gets allocated into a single company rather than into a fund’s diversified portfolio. The associated risk should be carefully evaluated, both on an individual deal basis and as part of a broader portfolio.

If you are interested in learning more about equity co-investments and how LVAM can help with this process, free to contact us at lvam@laconiacapitalgroup.com.

Originally published in the April 2019 LVAM Newsletter.