We stick to what we know

We invest in serious founders building “must have” technology for mission-critical industries.

Pre-seed & seed

$250k - $1M checks,

happy to lead

US & Canada mostly

B2B software focus

As entrepreneurs ourselves, we support founders with the only things that matter in the early days:

sales acceleration, operational execution, and capital strategy.

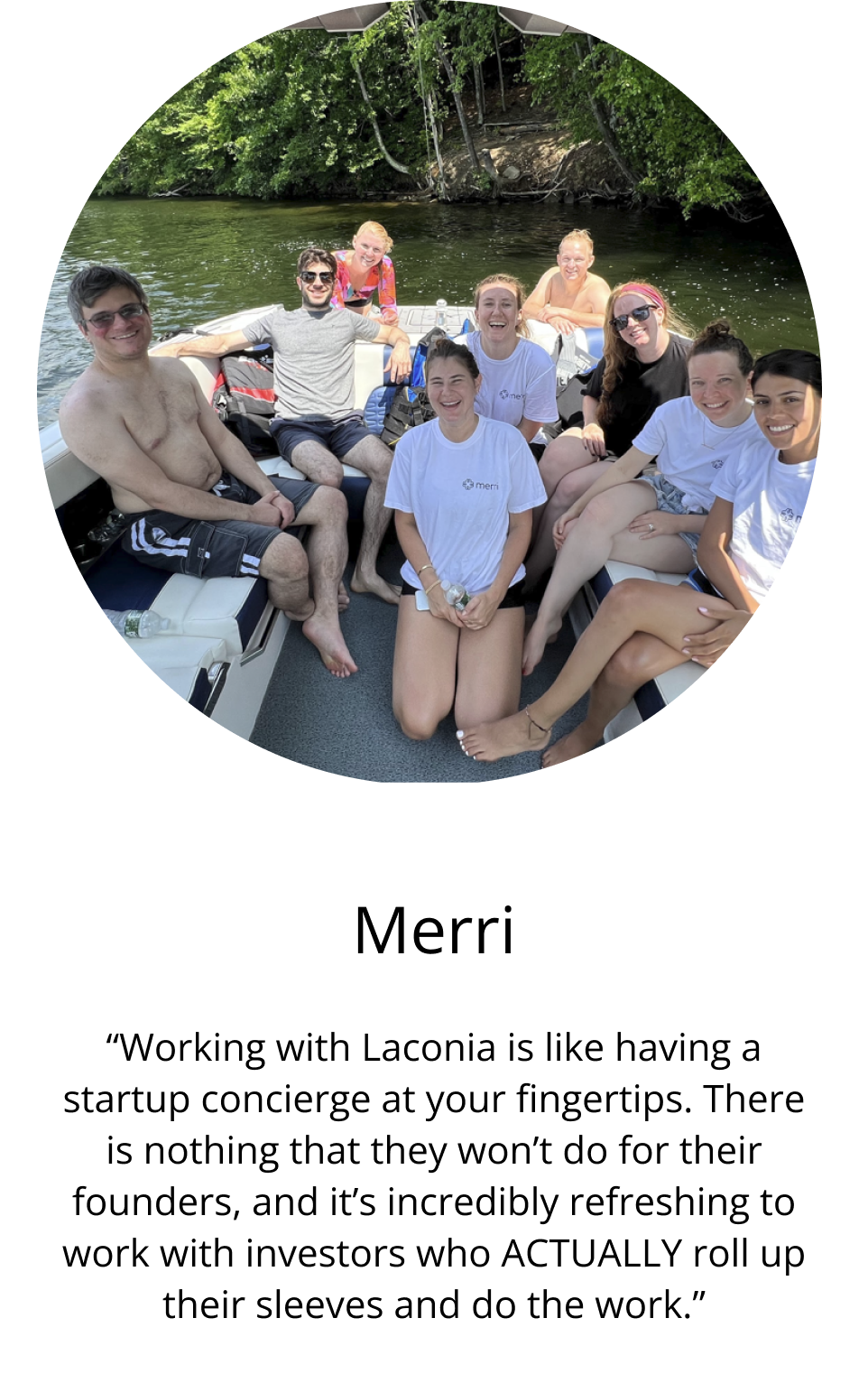

The founders we back (claim to) agree

We are built for seed

While many firms use early-stage investing as a way to source their next growth rounds, we’ve remained dedicated to the early days, where discipline, judgment, and hands-on support matter most. That focus has guided us for more than a decade, and the results speak for themselves.

Hear the stories of Laconia's founders

We are thrilled to spotlight the fearless leaders behind Laconia’s portfolio.

Their personal backgrounds, motivations, values, aspirations, and ambitions give us confidence that the best is yet to come.

Hear their stories, learn from their lessons, and support them on their missions in transforming how business is done.

More coming soon!

Meet our favorite portfolio companies

Yes, we love them all equally.

Current Investments

Legacy Investments Include

On the record

Stay tuned for our upcoming content series and highlights on our portfolio companies.

No warm intro needed

Pitches

If you are a pre-seed or seed b2b software founder raising capital, feel free to reach out to us below!

Internships + Fellowships

If you’re an aspiring investor at any stage of your career looking for an inside view into venture, check out our programs.