How did we get here?

Growing up with immigrant parents, in a small town in Israel, money moving in NYC was something you saw only in Trading Places. After graduating from law school in Tel Aviv, I spent 8 years in England and then moved to NYC right before ‘shelter in place’ was declared. Venture capital was never an obvious career choice for me, but here we are.

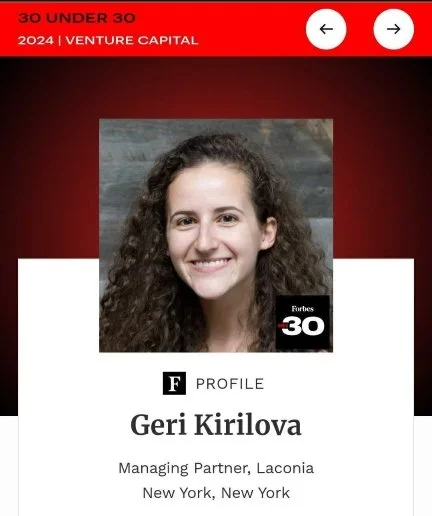

I’m joining Laconia after spending more than a decade building early-stage companies in the b2b software space globally (US, UK, Israel & Europe). I started my career in capital markets, and after my MBA I stumbled upon the world of venture-backed startups, taking on exciting roles such as Head of Growth & Customer Success at DueDil (Acquired by Artesian) and VP of Customer Operations at a high-growth early-stage edtech startup. I have had the good fortune of transforming companies and teams, driving results like going from $1M to $10M in ARR, building best-in-class customer acquisition and success playbooks, and closing investment rounds.

Excited by the speed of innovation venture-backed startups offer, I was fascinated by what other types of problems we could be solving using capital and technology. I embarked on a journey asking the following question: how can we use capital, power and innovation to solve big problems such as access to health and finance and gender and social inequalities? I moved to the land of infinite possibilities and joined cutting-edge operations all on the cusp of capital movement:

Founders Pledge, a startup helping founders give effectively, to high-impact charitable opportunities

51 Unicorns, an investment club aimed at female retail investors and gender smart investing

SeedImpact, an alternative investment firm orchestrating investment opportunities between mission-driven angel investors and underrepresented founders

Included VC, a venture fellowship for leaders on a mission to diversify and change the face of the VC industry.

They all sparked a massive fire in me, the underlying understanding that directing intentional capital is my calling.

Excited by this mission I went to look for my people and girl, did I find them. I have always been a firm believer that we invest in lines, not dots, and such was my relationship with the Laconia team. I was fortunate to have multiple opportunities to interact with the Laconia team from an Ask Me Anything session with Included VC, a round table about LP perspective hosted by IDiF, Laconia’s own Venture Cooperative AMAs, VC Unleashed events, practice pitch sessions, and more. The more data points I collected, I saw a clear line: the Laconia team is made up of smart, diverse, intentional and kind investors.

Why I fell in love with Laconia (and frankly, so did everyone else)

I am extremely humbled by the opportunity to join Laconia and it is the team, mission and impact that makes me excited the most. Laconia’s unique values, approach and impact are responsible for its success for almost 15 years and the reasons good people (founders, LPs, VCs and other partners) love to work with them. They were early investors in companies that have gone on to create major success like Triplelift ($1.4B exit), AutoFi ($700M+ valuation) and Ocrolus ($500M+ valuation), just to name a few, and other rising stars like Yuvo Health and Tender.

Values - Laconia’s values of Transparency, Collaboration and Community struck a chord with me. They know that uncovering the best investment opportunities requires demystifying venture capital’s insularity and enabling founders of all backgrounds to more easily access and navigate the venture world (learn more about who we are here). I have seen how they provide honest and straightforward feedback to founders, collaborate with their LPs and other VCs, and build deep communities.

Focus & hands-on approach - Laconia is built by experienced operators (sales, marketing and management) who invest in companies that are changing the way business is done. Their high conviction, high touch approach is compelling. They do not get phased by the hype culture. Instead, they back mature, grounded, and thoughtful founders using technology to solve high pain-point problems and inefficiencies within existing markets and workflows (more about our investment thesis and parameters here). In supporting portfolio companies, Laconia focuses on operational execution and sales acceleration, which are critical as founders find product market fit. They also help founders build an efficient capital strategy to run their businesses and achieve their next round of financing.

Intentionality & Impact - Most importantly, Laconia are intentional investors. Whether they are diving deep into diligence to understand the fundamental aspects of a business or launching initiatives to cast a wide net in sourcing, their efforts center around accessibility, diversity, and substance. They are not only just taking the talk, they walk the walk.

When it comes to identifying opportunities, Laconia opens its doors to any founders who are serious about building meaningful and resilient businesses. They host open hours and mentor meetings, participate in round tables and panels, and even launched the most accessible onramp to venture, The Venture Cooperative.

They do not have a specific DEI statement, separate initiative or quotas; instead, they are committed to removing barriers in every aspect of their operations, from deal sourcing and supporting founders to selecting their LPs and empowering the next generation of investors.

This intentionality has a real impact. In Fund III so far, we have backed diverse founding teams (44% women, 56% PoC, and 33% Black & Latinx). We have more than 850+ fellows from 30+ countries, 70% of whom are from underrepresented backgrounds. Many fellows have gone on to build their own venture studios, startup communities, angel syndicates, and more, creating net new resources for early-stage founders. If you read even one stat on our sector, you know that these achievements are unparalleled!

What’s next

I am humbled by the opportunity to join the Laconia team and extremely excited by their mission to redefine the way venture is done, finding diverse founders who are changing the way business is done, supporting the next generation of venture capitalists, and making an impact.

Over the past couple of months since joining, we have made two investments in companies with founders who are not only subject matter experts but also kind and thoughtful leaders. We hosted more than 150 people in our office during NYC Tech Week and met our NYC venture fellows in person. We hosted events with our LPs on AI and welcomed the new founders to our community, and there is a lot more to come!

We are currently investing out of our third fund, and we are very excited to welcome at least 10 more extraordinary founders who are changing the way business is done over the next couple of years. Some areas of interest include healthcare, SMB-enabling software, and financial infrastructure. We are also looking forward to continuing our relationships in the ecosystem, supporting the next generation of founders and investors through initiatives such as mentorship and events, joining The Venture Access Alliance, and kicking off the next cohort of our Venture Cooperative (applications are now open for our spring cohort - learn more here).

On a personal note, I want you to leave with this. The way I see it, the role of a VC investor is to back companies that identify deep pain points, deliver solutions that others find extremely valuable, and in turn create desirable financial outcomes for shareholders. It’s impossible to do all of the above without solving a diverse set of problems and creating value for a diverse set of people. Doing this successfully might not be easy, but I’d certainly like to try.

If you’ve made it this far and you’re a pre-seed/seed founder or investor in the B2B software space, I’d love to meet you. Feel free to say hi at the next NYC event! You can also find me on LinkedIn or email me at mirit [at] laconia capital group [dot] com.